About Hourglass Trader

Data-driven option selling tools and a community built around consistent, compounding returns — not overnight gambles.

Who We Are

We are traders who leverage primarily option selling strategies to work towards our goal of consistently outperforming the market. While option selling is our primary strategy, we have a data-driven approach which is applicable to all types of traders.

Our goal isn't to 10x a portfolio in a year. The big risks necessary to achieve those unrealistic returns are risks that more often send an account towards zero. Instead, we understand that a patient approach which generates consistent, compounding gains is the best way to grow your wealth. If you believe there are no shortcuts in the market, then this is the place for you.

One thing we pride ourselves on is that this is not a strategy where you need to be glued to the screen, constantly nailing entries and exits. It's designed to minimize screen time so that you are free to focus on your job, classes, or just going outside and enjoying the day.

Data-Driven

Every tool is backed by real market data, updated automatically throughout the trading day.

Low Screen Time

Our strategies are designed so you don't have to watch charts all day. Set it and live your life.

Consistent Returns

We focus on high-probability, compounding gains over time rather than chasing home runs.

What We Offer

We believe that anyone who wants to learn how to sell options should be able to do so for free. Because of that, all educational content and videos are, and will always be, free. Our chatroom also features free channels where you're encouraged to ask as many questions as you'd like. We have a supportive community that understands there is no such thing as a stupid question.

For those ready to take it to the next level, we offer two premium tiers:

Discord Access

Join a community of like-minded traders where we all aim to win together.

- Live trade alerts

- Weekly gameplans

- 24/7 market discussion

- All premium research articles

Trading Tools

Proprietary scanners and dashboards that power our data-driven approach.

- 6 real-time trading tools

- Auto-updated during market hours

- Built-in filters, sliders, and sorting

- Everything in Discord Access, plus tools

Trading Tools

A closer look at each tool included with a Trading Tools subscription. All tools update automatically during market hours.

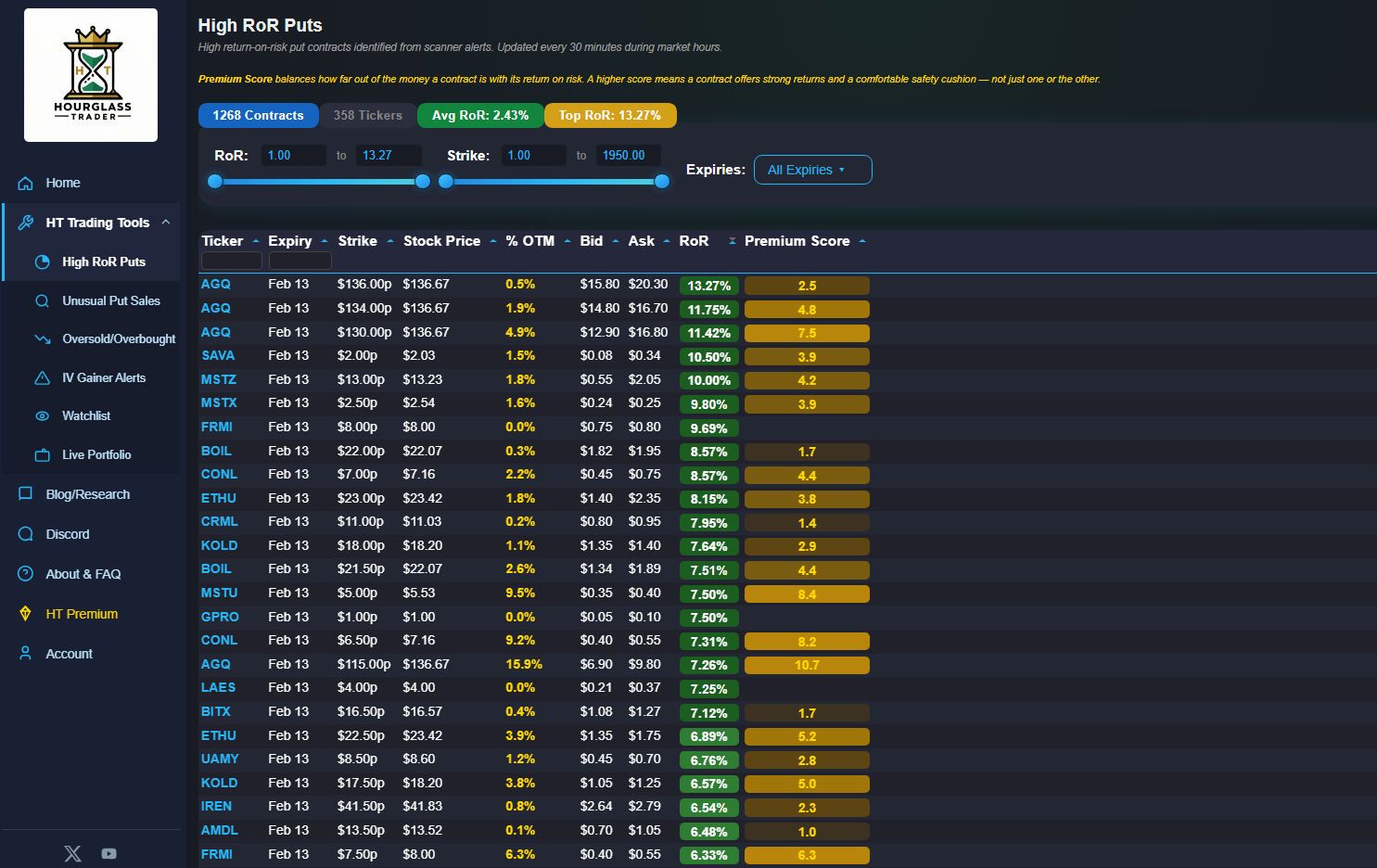

High RoR Put Scanner

Updated every 30 minScans the entire options market to surface put contracts with the highest return on risk (RoR). Each row shows the ticker, strike price, stock price, how far out of the money the contract is, and the bid/ask spread.

The Premium Score column balances RoR with distance out of the money. A high score means a contract offers strong returns and a comfortable safety cushion — not just one or the other. Use the RoR and Strike sliders to narrow results, and filter by expiry date.

Tip: While this scanner returns put options, stocks with high put premiums also have high call premiums — making this scanner useful for both sides of the trade.

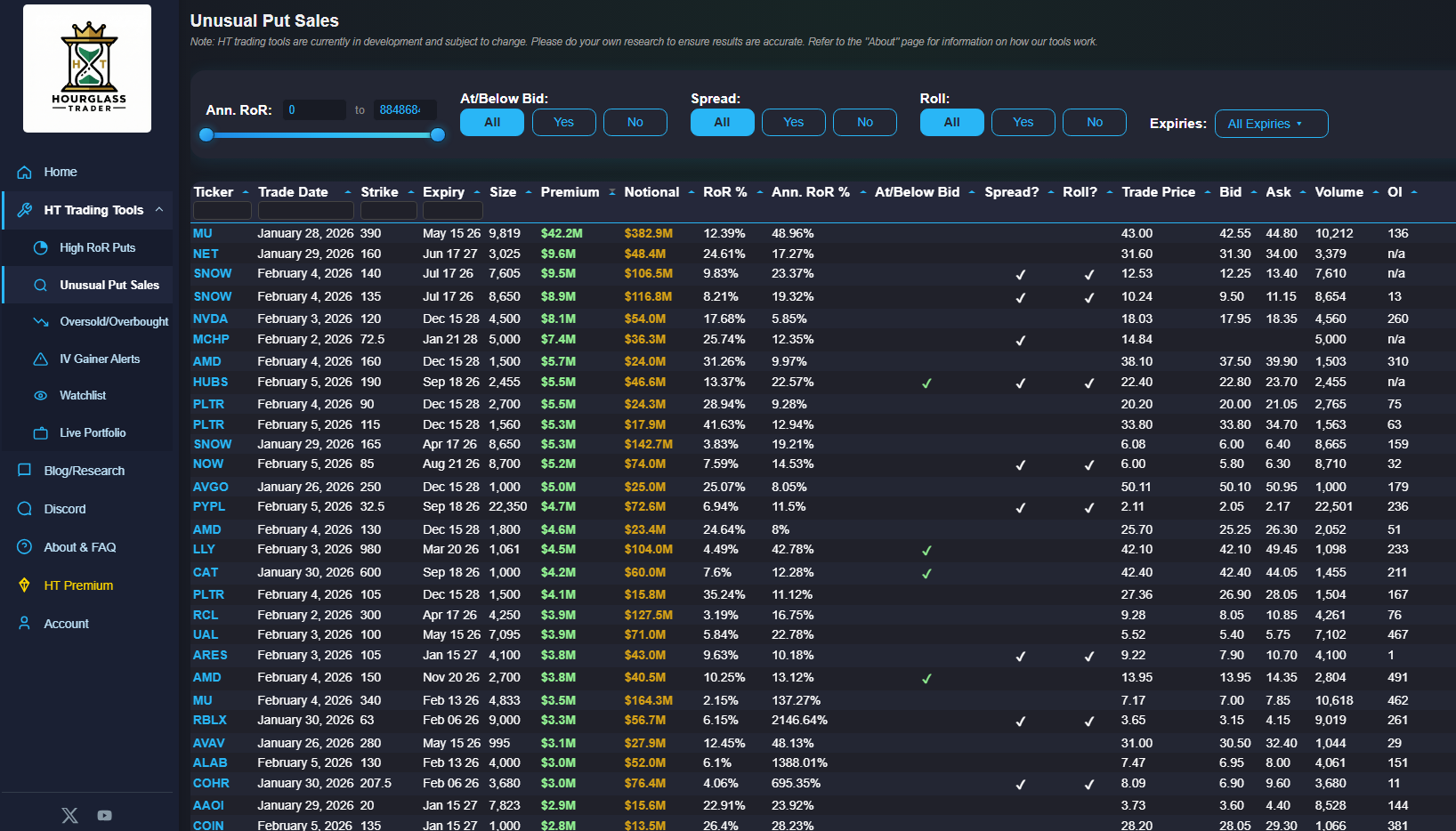

Unusual Put Sale Scanner

Updated every 30 minOne of our favorites. This scanner flags large, unusual opening put sales so you can follow institutional money. When big players sell puts aggressively, it often signals conviction that a stock will hold or rise. The Notional column shows the dollar size of each trade so you can see exactly how much capital is behind it.

Key columns to watch:

- At/Below Bid: The trade was executed at or below the bid price — very aggressive and bullish. These are the ones to pay closest attention to.

- Spread: If this is checked and nothing else, the trade is part of a spread and should not be viewed as a standalone opening put sale.

- Roll: Indicates the trader is rolling an existing position to a new expiry or strike — still a bullish signal that they want to maintain the position.

In short: Filter for "At/Below Bid = Yes" and "Spread = No" to find the highest-conviction opening put sales from institutional traders.

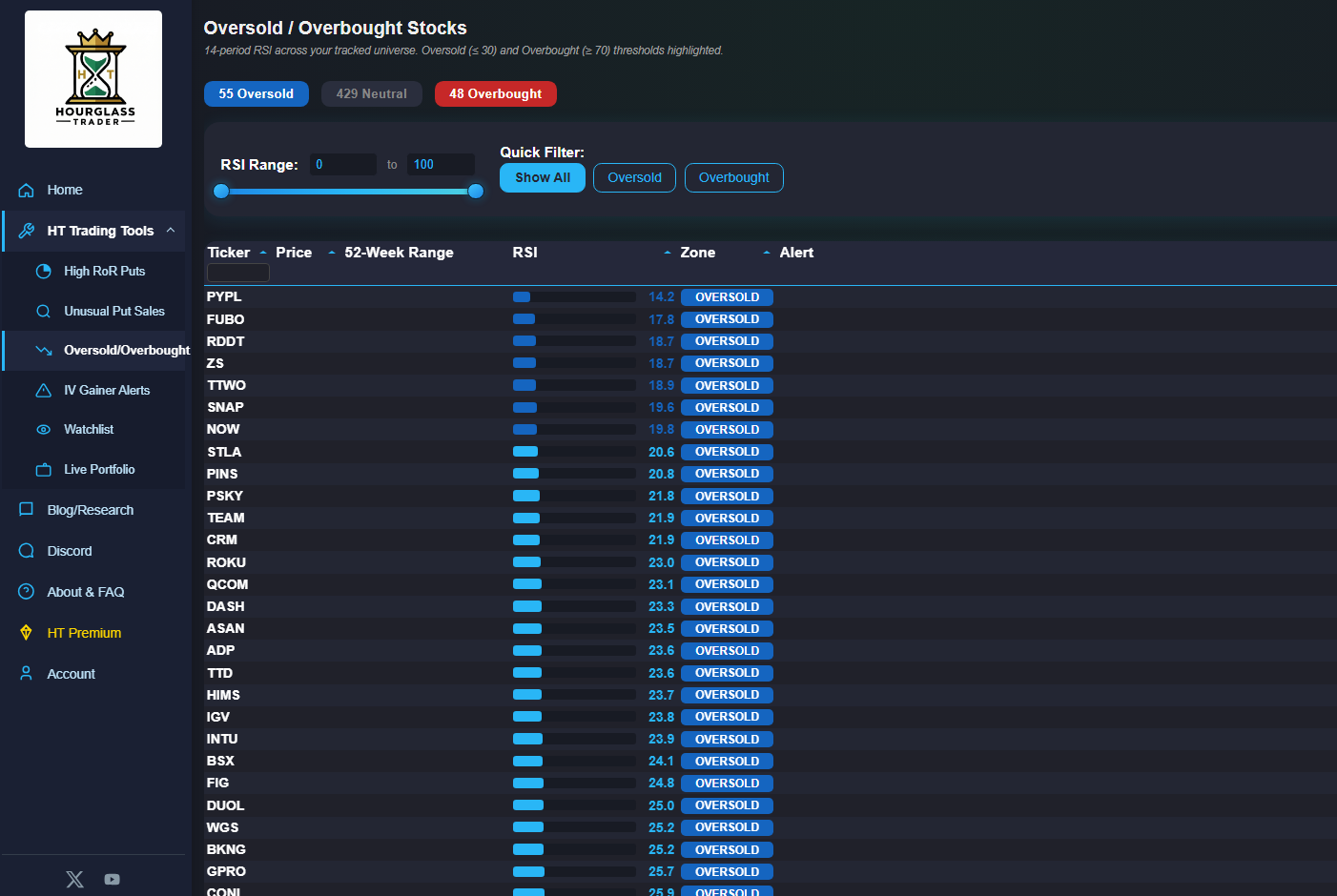

Oversold / Overbought Scanner

Updated every 30 minCalculates the 14-period RSI for every stock in our tracked universe and surfaces oversold (RSI ≤ 30) and overbought (RSI ≥ 70) opportunities. Each stock also shows its current price and where it sits within its 52-week range.

The Alert column flags particularly interesting setups: stocks that are oversold and near their 52-week low, or overbought and near their 52-week high. These are the tickers approaching potential inflection points worth watching closely.

Use the RSI slider or quick-filter buttons to isolate exactly the zone you're interested in.

IV Gainer Alerts

Updated every 5 minMonitors the entire stock market in real time and flags stocks experiencing sudden spikes in both price and implied volatility. The scanner compares each stock's current ATM implied volatility against its 30-day historical volatility to confirm that IV has genuinely spiked — not just price.

When IV spikes temporarily, option premiums become inflated. This creates an opportunity to sell options at elevated prices and profit when volatility reverts to normal. The IV Premium column shows how many times higher current IV is relative to normal — the higher the number, the more elevated the premium.

Strategy: For more on how we use IV reversion to generate high-probability trades, check out the IV reversion video on our YouTube channel.

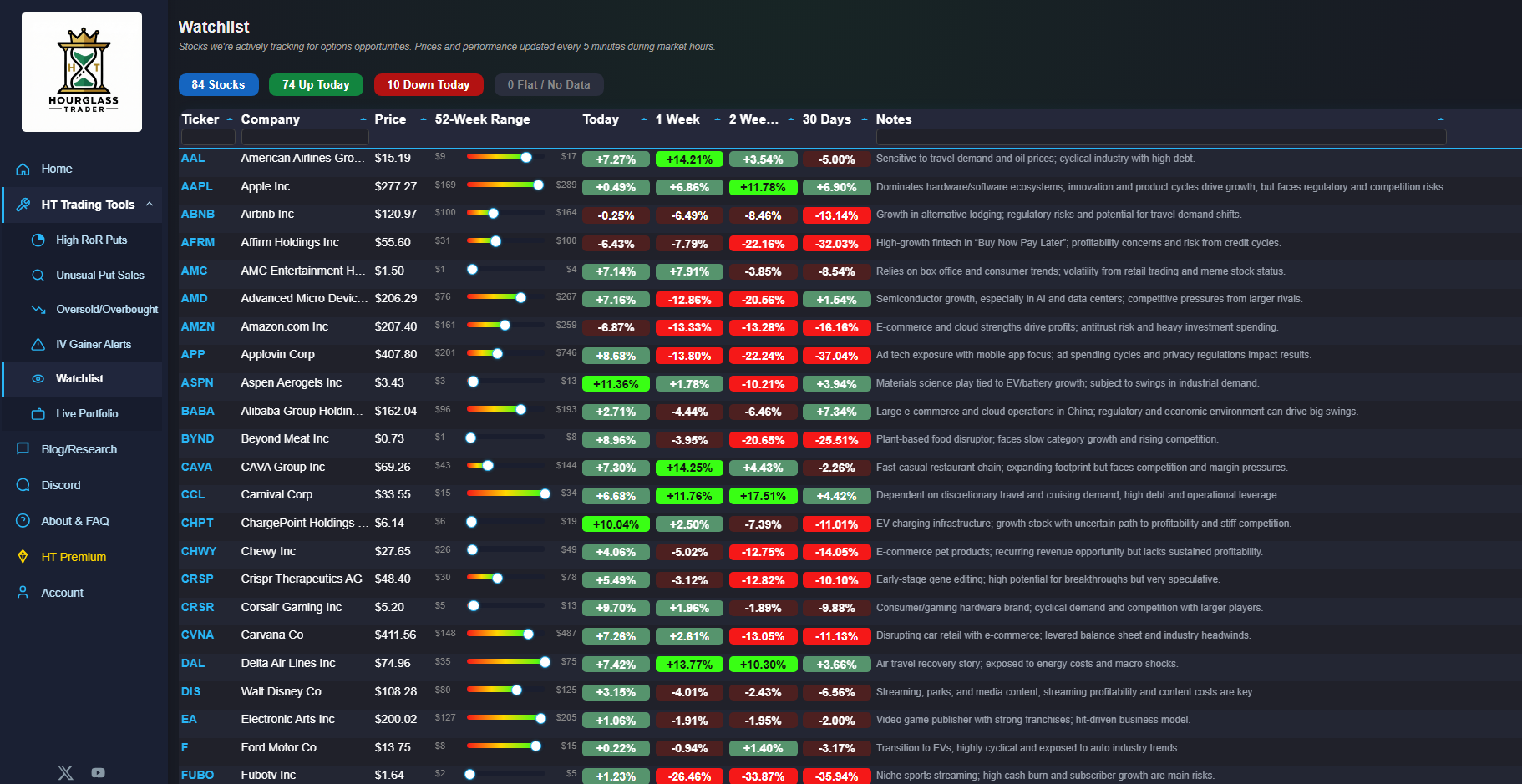

Watchlist

Updated every 5 minA live dashboard of stocks we're actively tracking for options opportunities. Each stock shows its current price, 52-week range (with a visual bar showing where price sits today), and performance across multiple timeframes: today, 1 week, 2 weeks, and 30 days.

The Notes column includes a brief thesis for why each stock is on our radar — useful context when deciding whether an opportunity aligns with your own research.

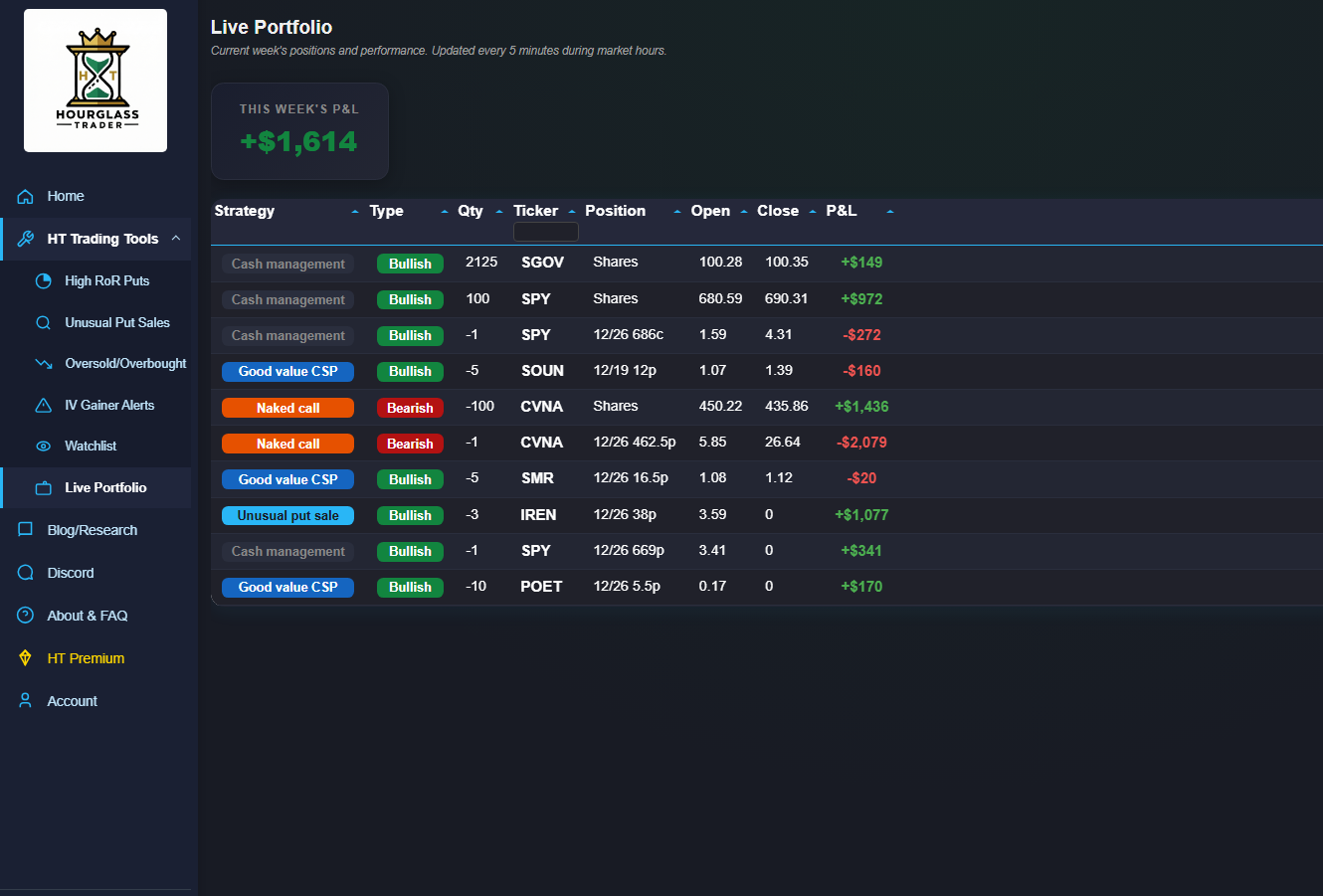

Live Portfolio

Updated every 5 minSee exactly what we're trading in real time. The Live Portfolio shows every open position, the strategy behind it, direction (bullish/bearish), entry price, current price, and live P&L. A banner at the top displays the week's total profit or loss.

While our tools can surface a lot of great data, there are no trades we're more confident in than the ones where we put our own money on the line. This is the most transparent way to see how we're executing our strategies.

Frequently Asked Questions

Quick answers to common questions about Hourglass Trader.

Hourglass Trader is an options-focused trading platform that combines proprietary scanning tools, educational content, and a community of like-minded traders. Our focus is on option selling strategies that generate consistent, compounding returns.

Yes. All educational videos, written guides, and blog content are completely free and always will be. Our Discord also has free channels where you can ask questions and learn from the community. Premium tiers unlock the trading tools and additional Discord channels.

Discord Access gives you full access to our premium Discord channels including live trade alerts, weekly gameplans, market discussion, and all premium research articles.

Trading Tools includes everything in Discord Access plus full access to all six proprietary trading tools on this website (High RoR Puts, Unusual Put Sales, Oversold/Overbought, IV Gainer Alerts, Watchlist, and Live Portfolio).

It depends on the tool. The IV Gainer Alerts, Watchlist, and Live Portfolio update every 5 minutes during market hours (9:30 AM – 4:00 PM ET). The High RoR Puts, Unusual Put Sales, and Oversold/Overbought scanners update every 30 minutes. All tools pull live market data automatically.

Not at all. Our free educational content is designed to take you from beginner to comfortable with option selling fundamentals. The tools are built to be intuitive, and our Discord community is always happy to help answer questions. Everyone starts somewhere.

No. The Live Portfolio is meant to provide transparency into how we're executing our strategies, not as a list of trades to blindly follow. Your account size, risk tolerance, and goals are different from ours. Always do your own research and make sure any trade fits your personal situation.

Log in and visit your Account page. You can cancel anytime with one click. If you run into any issues, shoot us an email and we'll take care of it.

Monthly and lifetime products: All sales are final.

Annual renewals: If your subscription auto-renews and you intended to cancel, contact us within 14 days of the renewal date to receive a full refund.

Important Disclaimer

We are not financial advisors. The information provided is for educational purposes only and should not be considered financial advice. Always do your own research and consult with a licensed professional before making investment decisions.